Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

The Truth About Down Payments (It’s Not What You Think)

Buying a home is exciting… until you start thinking about the down payment. That’s when the worry can set in.

“I’ll never save enough.”

“I need a small fortune just to get started.”

“I guess I’ll just rent forever.”

Sound familiar? You’re not alone. And you’re definitely not out of luck.

Here’s the thing: a lot of what you’ve heard about down payments just isn’t true. And once you know the facts, you might realize you’re a lot closer to owning a home than you think.

Let’s break it all down and bust some big down payment myths while we’re at it.

Myth 1: “I need to come up with a big down payment.”

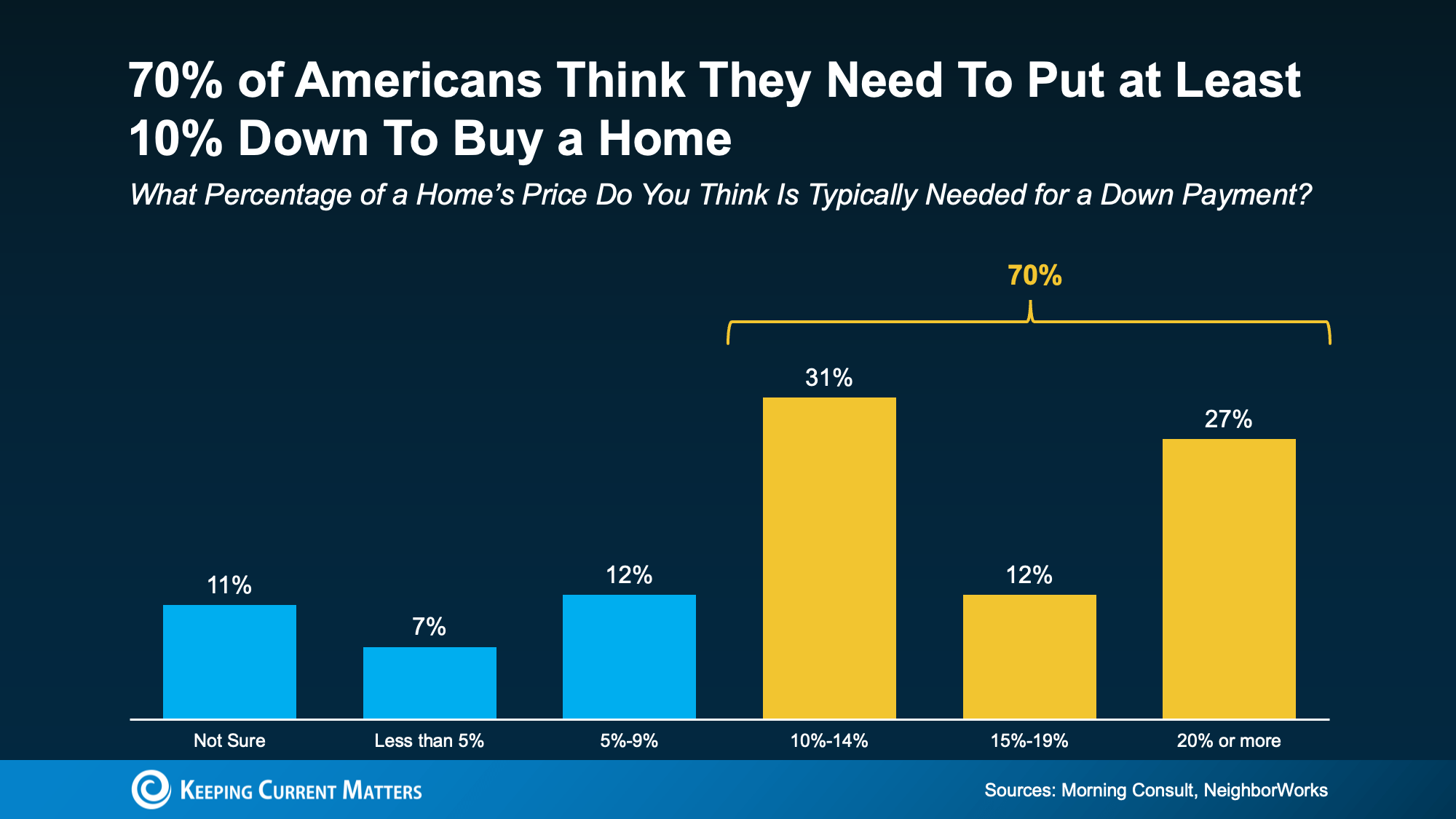

This one stops a lot of people in their tracks. A recent poll from Morning Consult and NeighborWorks shows 70% of Americans think they need to put at least 10% down to buy a home. And 11% aren’t sure what’s required at all (see graph below):

The truth? According to the National Association of Realtors (NAR), the typical down payment for first-time buyers has been between 6% and 9% since 2018. But there’s more to the story. If you qualify for an FHA loan, you may only need to put 3.5% down. And VA loans typically don’t require a down payment at all. So, there are options out there that can really make a difference for some buyers.

The truth? According to the National Association of Realtors (NAR), the typical down payment for first-time buyers has been between 6% and 9% since 2018. But there’s more to the story. If you qualify for an FHA loan, you may only need to put 3.5% down. And VA loans typically don’t require a down payment at all. So, there are options out there that can really make a difference for some buyers.

Myth 2: “It’ll take forever to save up for a down payment.”

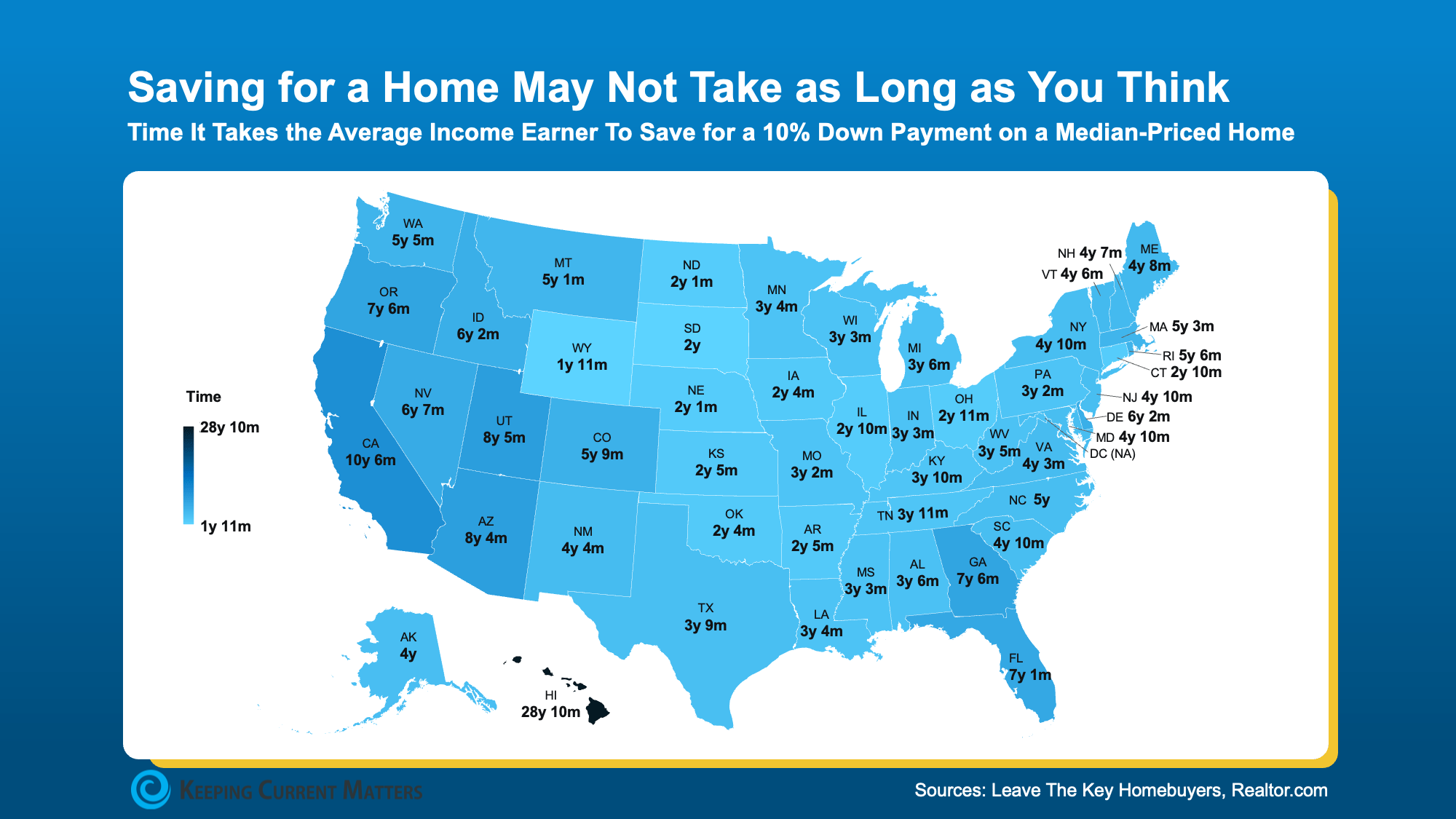

Sure, saving can take time. But it may not have to be as long as you think. In many states, reaching your goal can happen faster than you might expect, especially when you know your budget and have a clear savings plan.

According to a new study, the amount of time varies depending on where you live. The map below shows, on average, how many years it takes to save up for a 10% down payment based on typical home values and income levels in each state (see map below):

But remember, in most cases you won’t even need a down payment as large as 10%. Plus, no matter how much money you end up putting down, it won’t all have to come out of your pocket. Here’s why.

But remember, in most cases you won’t even need a down payment as large as 10%. Plus, no matter how much money you end up putting down, it won’t all have to come out of your pocket. Here’s why.

Myth 3: “I have to do it all on my own.”

This is one of the biggest myths of all. The reality is, there are thousands of down payment assistance programs out there, and the same poll from Morning Consult and NeighborWorks shows 39% of people don’t even know about them. That means a lot of potential homebuyers could already be closer to homeownership – they just don’t realize it.

These assistance programs are designed to help people like you who are ready to own a home but just need a little support getting started. As Miki Adams, President at CBC Mortgage Agency, explains:

“With high interest rates and soaring home prices, down payment assistance is more essential than ever.”

Bottom Line

If you’ve been putting off buying a home because the down payment feels like too much to tackle, talk to a local real estate agent. You may not need as much as you think, and there are plenty of resources out there, so you don’t have to do it alone. You just need an expert to point you in the right direction.

If the down payment wasn’t the thing holding you back, would you be ready to start your home search?

Selling and Buying at the Same Time? Here’s What You Need To Know

If you’re a homeowner planning to move, you’re probably wondering what the process is going to look like and what you should tackle first:

- Is it better to start by finding your next home?

- Or should you sell your current house before you go out looking?

Ultimately, what’s right for you depends on a lot of factors. And that’s where an agent’s experience can really help make your next step clear.

They know your local market, the latest trends, and what’s working for other homeowners right now. And they’ll be able to make a recommendation based on their expertise and your needs.

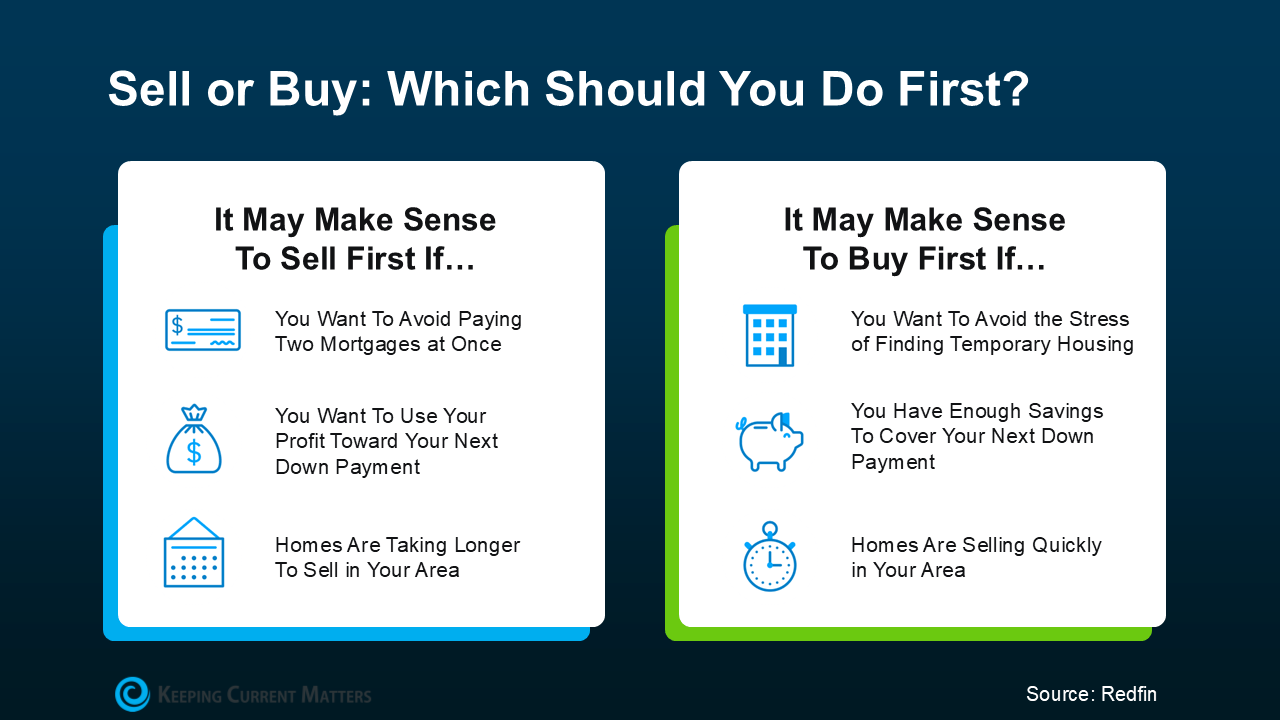

But here’s a little bit of a sneak peek. In many cases today, getting your current home on the market first can put you in a better spot. Here’s why that order tends to work best (and how an agent can help).

The Advantages of Selling First

1. You’ll Unlock Your Home Equity

Selling your current home before you try to buy your next one allows you to access the equity you’ve built up – and based on home price appreciation over the past few years, that’s no small number. Data from Cotality (formerly CoreLogic) shows the average homeowner is sitting on $302K in equity today.

And once you sell, you can use that equity to pay for the down payment on your next house (and maybe even more). You could even have enough to buy your next house in cash. That’s a big deal, and it could make your next move a whole lot easier on your wallet.

2. You Won’t Be Juggling Two Mortgages

Trying to buy before you sell means you could wind up holding two mortgages, even if just for a few months. That can get expensive, fast – especially if there are unexpected repairs or delays. Selling first removes that stress and helps you move forward without the financial strain. As Ramsey Solutions says:

“It’s best to sell your old home before buying a new one to avoid unnecessary risks and possible headaches.”

3. You’ll Be in a Stronger Position When You Make an Offer

Sellers love a clean, simple offer. If you’ve already sold your house, you don’t need to make your offer contingent on that sale – and that can help you stand out. Your agent can position your offer to be as strong as possible, so you have the best shot at getting the home you want.

This can be a big advantage in competitive markets where sellers prefer buyers with fewer strings attached.

One Thing To Keep in Mind

But, like with anything in life, there are tradeoffs. As you weigh your options, consider this potential drawback, too:

1. You May Need a Place To Stay (Temporarily)

Once your house sells, you may need a short-term rental or to stay with family until you can move into your next home. Your agent can help you negotiate things like a post-closing occupancy (renting the home from the buyer for a set period) or flexible closing dates to help smooth out that transition as much as possible.

Here’s a simple visual that can help you think through your options (see below):

But the best way to determine what’s best for you and your specific situation? Talk to a trusted local agent.

But the best way to determine what’s best for you and your specific situation? Talk to a trusted local agent.

Bottom Line

In many cases, selling first doesn’t just give you clarity, it gives you options. It helps you buy with more confidence, more financial power, and less pressure.

If you’re ready to make a move but not sure where to begin, talk to a local agent. They’ll walk you through your equity, your timing, and your local market so you can decide what’s right for you.

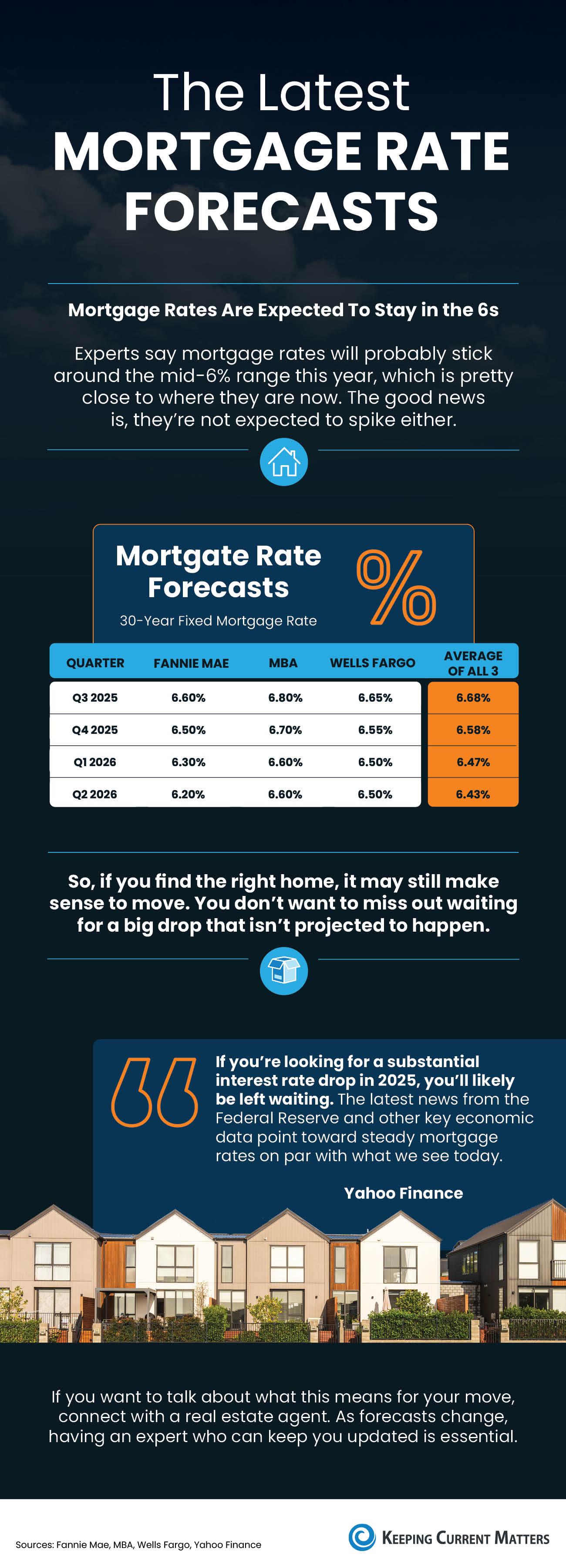

The Latest Mortgage Rate Forecasts

Some Highlights

- If you’re tempted to delay your move in hope that mortgage rates will come down, you may want to rethink that strategy based on the latest forecast.

- Experts say mortgage rates are projected to stay in the 6s this year. So don’t expect a big drop.

- If you want to talk about what this means for your move, connect with a real estate agent. As forecasts change, having an expert who can keep you updated is essential.

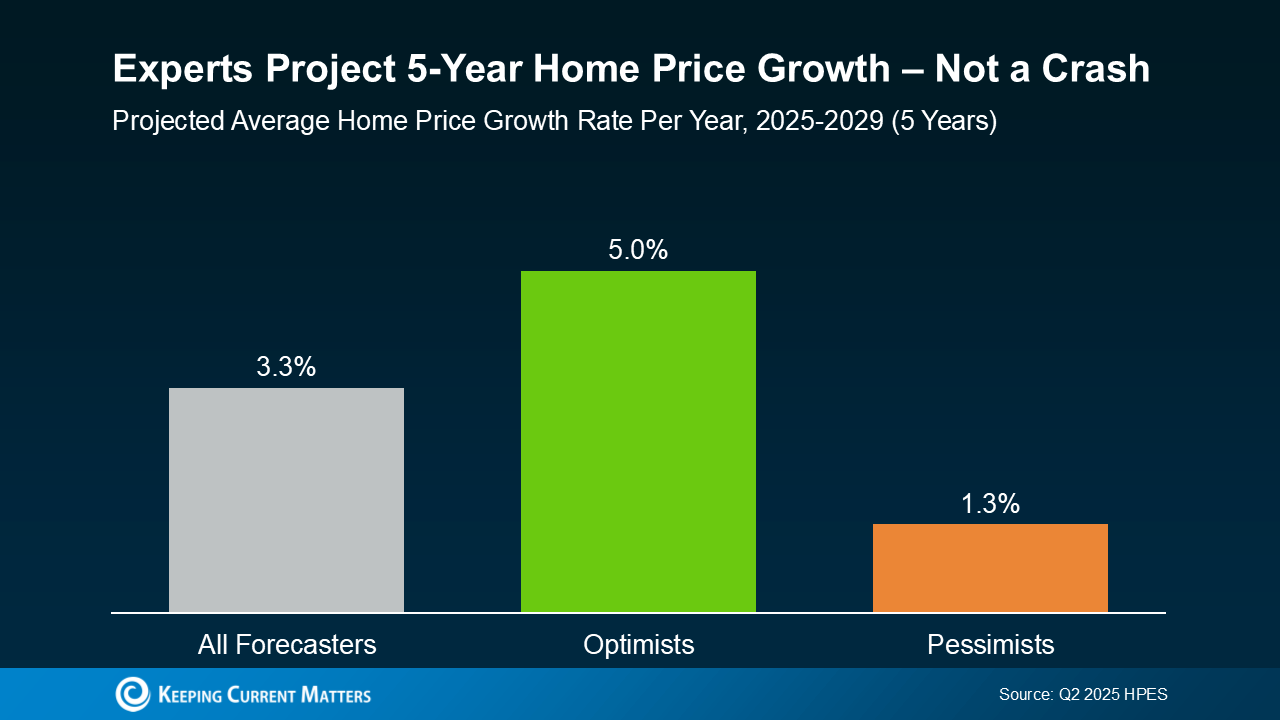

The Truth About Where Home Prices Are Heading

There are plenty of headlines these days calling for a housing market crash. But the truth is, they’re not telling the full story. Here’s what’s actually happening, and what the experts project for home prices over the next 5 years. And spoiler alert – it’s not a crash.

Yes, in some local markets, prices are flattening or even dipping slightly this year as more homes hit the market. That’s normal with rising inventory. But the bigger picture is what really matters, and it’s far less dramatic than what the doom-and-gloom headlines suggest. Here’s why.

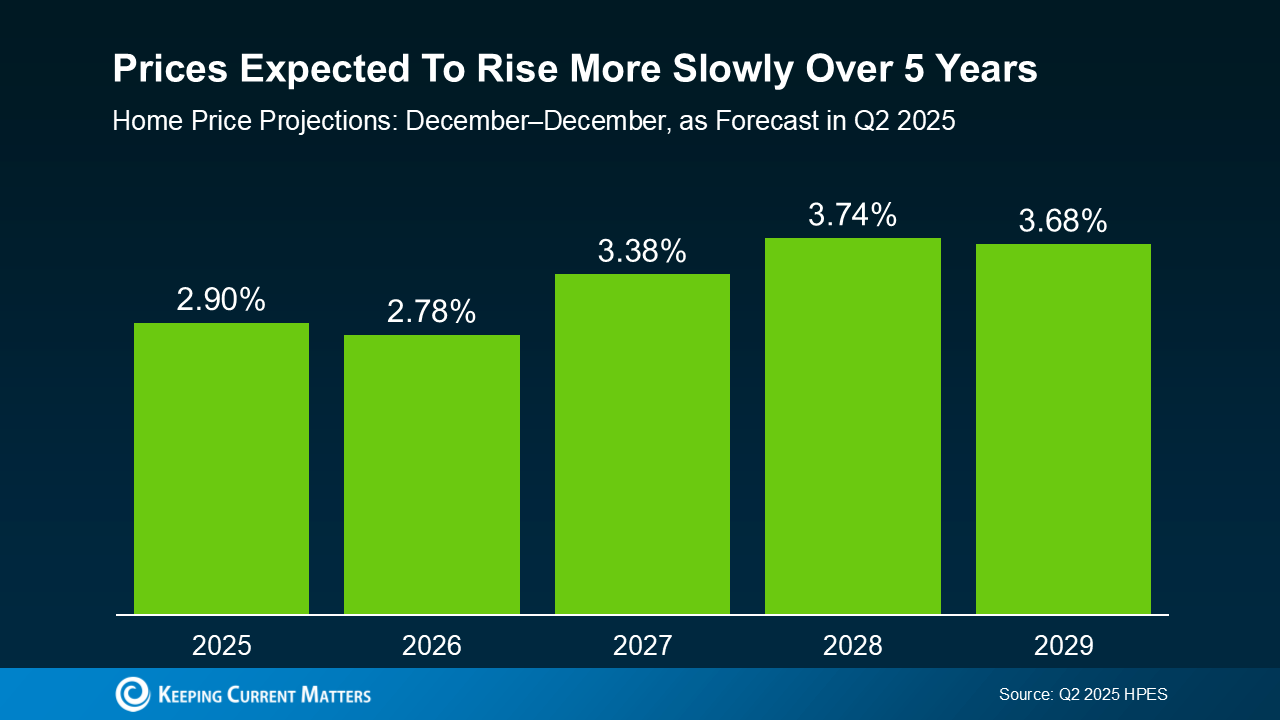

Over 100 leading housing market experts were surveyed in the latest Home Price Expectations Survey (HPES) from Fannie Mae. Their collective forecast shows prices are projected to keep rising over the next 5 years, just at a slower, healthier pace than what we’ve seen more recently. And that kind of steady, sustainable growth should be one factor to help ease your fears about the years ahead (see graph below):

And if you take a look at how the various experts responded within the survey, they fall into three main categories: those that were most optimistic about the forecast, most pessimistic, and the overall average outlook.

Here’s what the breakdown shows:

- The average projection is about 3.3% price growth per year, through 2029.

- The optimists see growth closer to 5.0% per year.

- The pessimists still forecast about 1.3% growth per year.

Do they all agree on the same number? Of course not. But here’s the key takeaway: not one expert group is calling for a major national decline or a crash. Instead, they expect home prices to rise at a steady, more sustainable pace.

That’s much healthier for the market – and for you. Yes, some areas may see prices hold relatively flat or dip a bit in the short term, especially where inventory is on the rise. Others may appreciate faster than the national average because there are still fewer homes for sale than there are buyers trying to purchase them. But overall, more moderate price growth is cooling the rapid spikes we saw during the frenzy of the past few years.

And remember, even the most conservative experts still project prices will rise over the course of the next 5 years. That’s also because foreclosures are low, lending standards are in check, and homeowners have near record equity to boost the stability of the market. Together, those factors help prevent a wave of forced sales, like the kind that could drag prices down. So, if you’re waiting for a significant crash before you buy, you might be waiting quite a long time.

Bottom Line

If you’ve been on the fence about your plans, now’s the time to get clarity. The market isn’t heading for a crash – it’s on track for steady, slow, long-term growth overall, with some regional ups and downs along the way.

Want to know what that means for your neighborhood? Because national trends set the tone, but what really matters is what’s happening in your zip code. Connect with a real estate agent to have a quick conversation so you can see exactly what the local data means for you.

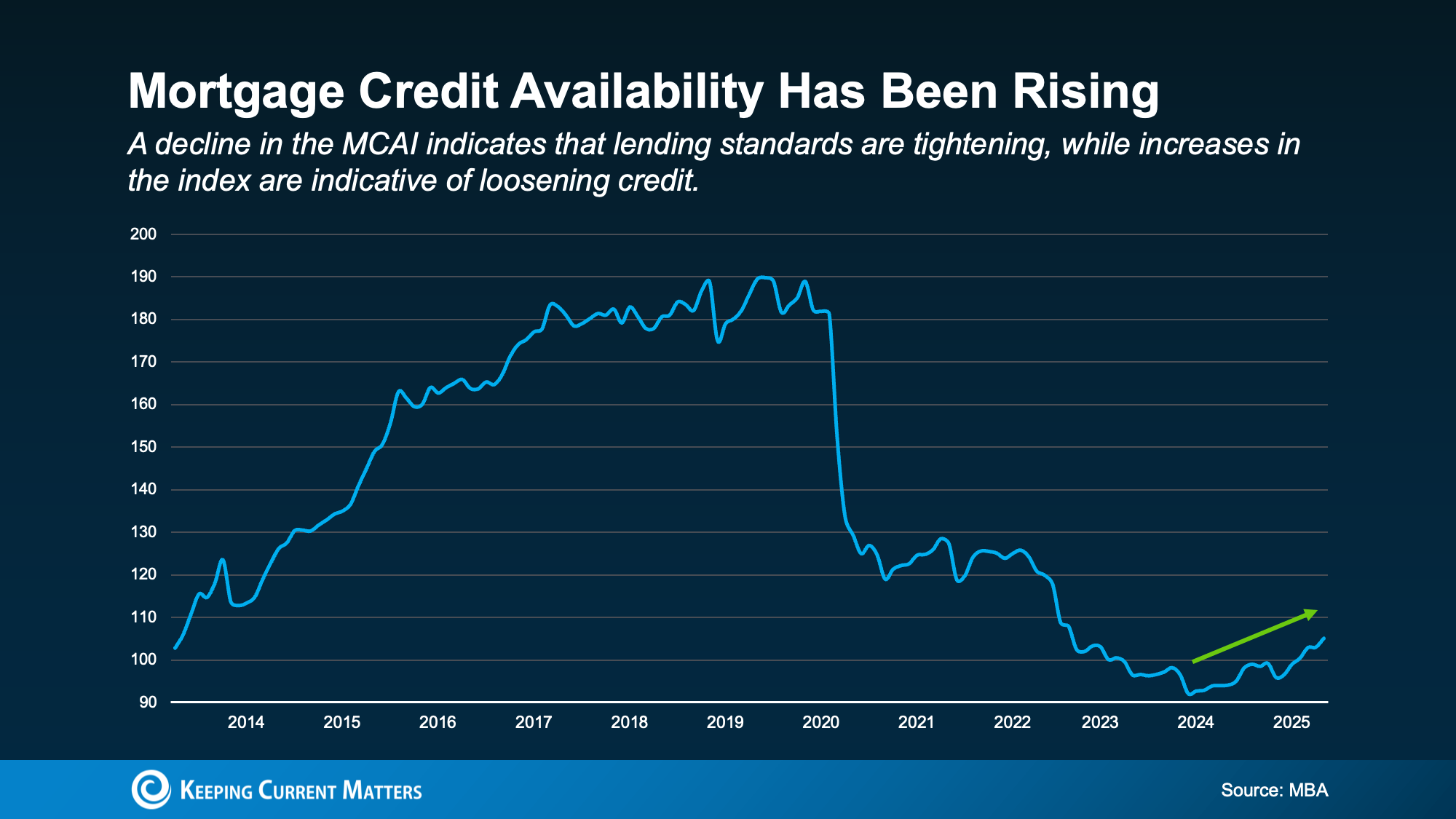

What You Should Know About Getting a Mortgage Today

If you’ve been putting off buying a home because you thought getting approved would be too hard, know this: qualifying for a mortgage is starting to get a bit more achievable, but lending standards are still strong.

Lenders are making it slightly easier for well-qualified buyers to access financing, which is opening more doors for people ready to make a move.

So, if strict requirements were holding you back, this shift could be the opportunity you’ve been waiting for, without repeating the risky lending practices that led to the housing crash back in 2008.

Lenders Are Opening More Doors

Banks are offering credit to more people in an effort to boost activity in the housing market, including buyers who have lower credit scores or smaller down payments. And that means more people are getting approved for mortgages.

But it doesn’t mean we’re heading for another crash like 2008. Even with the slight easing lately, lending standards today are still much tighter than they were back then.

According to the Mortgage Bankers Association (MBA), the Mortgage Credit Availability Index (MCAI) has been going up. This index shows how easy or hard it is for people to get a mortgage.

When the index rises, it means banks are easing their lending standards. And in May, credit availability hit its highest point in almost three years (see graph below):

Why does this matter to you? It means you may now be able to qualify for a mortgage that you wouldn’t have just a few months ago. The National Association of Underwriters (NAMU) explains:

Why does this matter to you? It means you may now be able to qualify for a mortgage that you wouldn’t have just a few months ago. The National Association of Underwriters (NAMU) explains:

“Mortgage credit availability surged in May, reaching its highest level since August 2022. The uptick signals that lenders are increasingly willing to loosen underwriting standards, providing borrowers with greater access to financing options . . .”

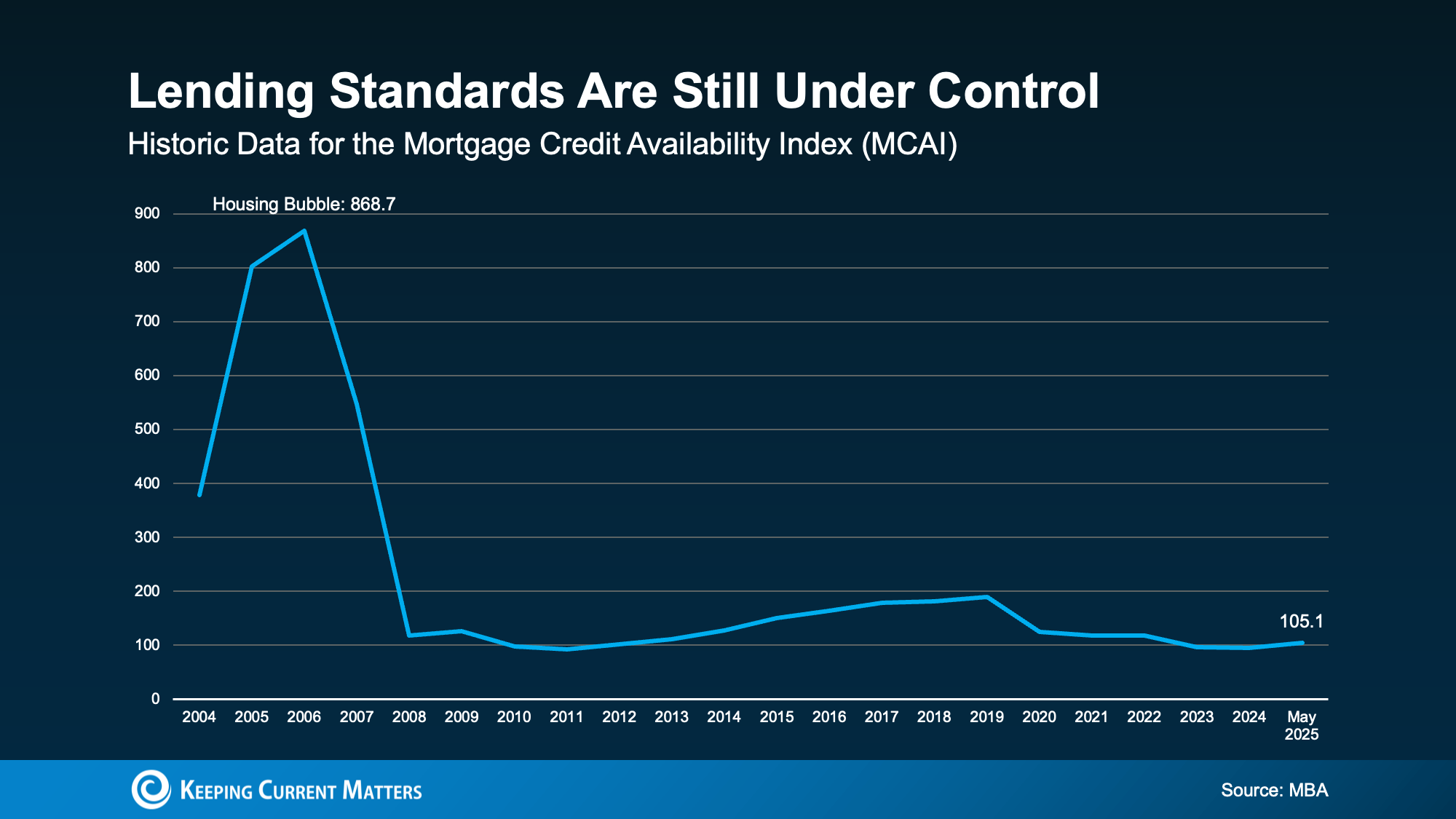

But What About 2008?

Now, you might be thinking, “Didn’t looser lending standards play a role in the 2008 housing crash?” That’s a smart question – and an important one. But here’s the difference. While credit availability is rising, lending standards are still under control.

Based on MCAI data going all the way back to 2004, today’s lending levels are still way below what they were leading up to the housing bubble (see graph below):

So, increasing mortgage credit availability right now isn’t a concern. It’s just a good thing for anyone looking to buy a home. As Brett Hively, SVP of Mortgage, Finance, and Strategy at Ameris Bancorp, recently said:

So, increasing mortgage credit availability right now isn’t a concern. It’s just a good thing for anyone looking to buy a home. As Brett Hively, SVP of Mortgage, Finance, and Strategy at Ameris Bancorp, recently said:

“This uptick is opening the door for many borrowers to move forward with a home purchase or a refinance program.”

Bottom Line

So, if you’ve been holding back because you thought you couldn’t get approved for a mortgage, it’s worth finding out what’s possible today. Talk with a lender about your options to see if you’re ready to take that next step toward homeownership.

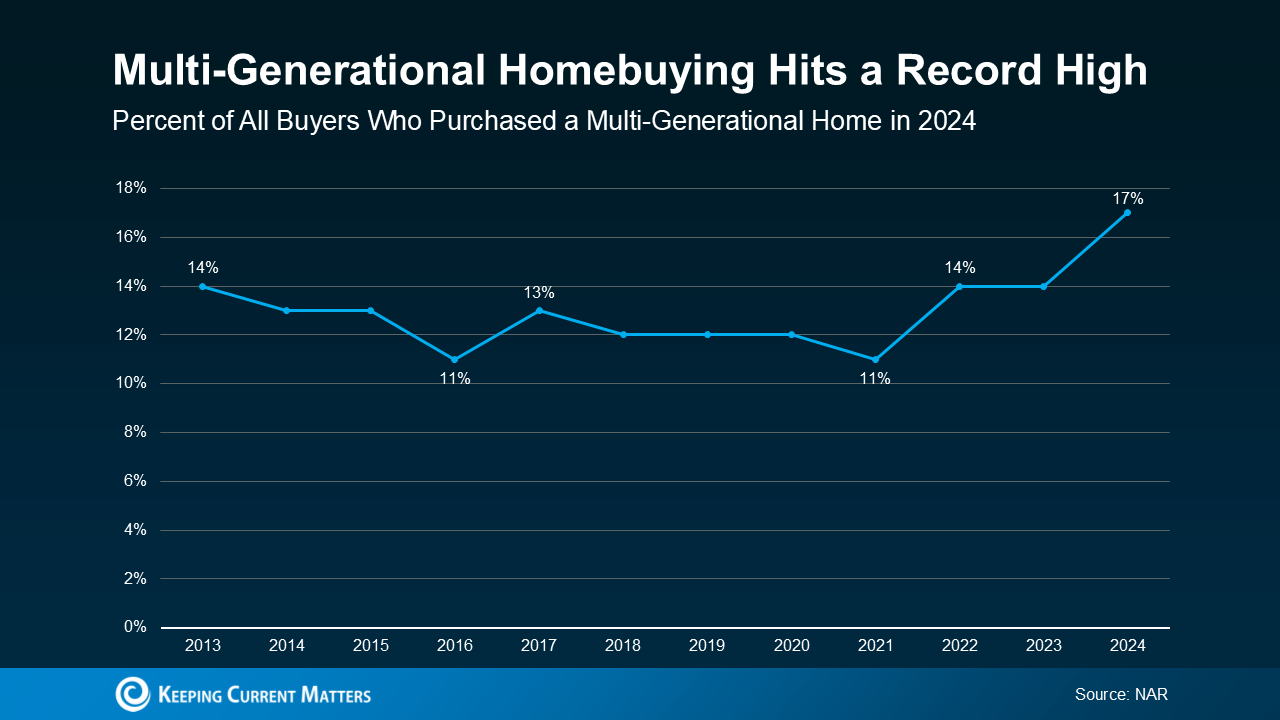

Multi-Generational Homebuying Hit a Record High – Here’s Why

Multi-generational living is on the rise. According to the National Association of Realtors (NAR), 17% of homebuyers purchase a home to share with parents, adult children, or extended family. That’s the highest share ever recorded by NAR (see graph below):

And what’s behind the increase? Affordability. NAR explains:

And what’s behind the increase? Affordability. NAR explains:

“In 2024, a notable 36% of homebuyers cited “cost savings” as the primary reason for purchasing a multigenerational home—a significant increase from just 15% in 2015.”

In the past, caregiving was the leading motivator – especially for those looking to support aging parents. And while that’s still important, affordability is now the #1 motivator. And with current market conditions, that’s not really a surprise.

Pooling Resources Can Help Make Homeownership Possible

With today’s home prices and mortgage rates, it can be hard for people to afford a home on their own. That’s why more families are teaming up and pooling their resources.

By combining incomes and sharing expenses like the mortgage, utility bills, and more, multi-generational living offers a way to overcome financial challenges that might otherwise put homeownership out of reach. As Rick Sharga, Founder and CEO at CJ Patrick Company, explains:

“There are a few ways to improve affordability, at least marginally. . . purchase a property with a family member — there are a growing number of multi-generational households across the country today, and affordability is one of the reasons for this.”

But this strategy doesn’t just help with affordability. It may even allow you to get a larger home than you’d qualify for on your own and that gives everyone a bit more breathing room. As Chris Berk, VP of Mortgage Insights at Veterans United, explains:

“Multigenerational homes are more than a trend: They are a meaningful solution for families looking to care for one another while making the most of their homebuying power.”

And momentum may be growing. Nearly 3 in 10 (28%) of homebuyers say they’re planning to purchase a multi-generational home.

Maybe it’s a solution that would make sense for you too. The best way to find out? Talk to a local real estate agent who can help you decide if this option would work for you.

Bottom Line

If your budget feels tight, buying a multi-generational home could be a smart solution.

Would you ever consider buying a home with a family member? Why or why not?

Connect with an agent to talk through your options.

Why Homeownership Is Going To Be Worth It

Life can feel a bit unpredictable these days. What’s happening with inflation? The economy? The housing market? But in the middle of all that uncertainty, there’s one thing a lot of people still crave – a place to call their own.

Because when everything else feels up in the air, home can be the thing that grounds you. As the experts at 1000WATT put it:

“Homeownership isn’t primarily financial anymore. . . Across all demographics, emotional and lifestyle factors consistently outrank wealth-building as motivators.”

Here’s what owning a home can mean for you, especially right now.

Freedom To Make It Yours

When you’re a homeowner, you don’t need to ask permission to paint a wall, hang a gallery of your favorite art, or redo the floors. You have the freedom to create a space that reflects who you are, all the way from the light fixtures to the paint colors.

Pro Tip: Just be mindful about exterior changes, if you buy a home in a community that has a homeowner’s association (HOA). There may be some approvals you’d need to get for select outdoor changes.

More Privacy, More Peace

Owning your home can give you a sense of peace you didn’t even realize you were missing. It’s a comfortable place where you feel secure and can relax, enjoy your privacy, and unwind after a long day.

Room To Grow

Whether it’s starting a family, setting up a home office for your new career, or finally building that home gym in the garage so you can hit your fitness goals, owning gives you the space to live life on your terms.

A Stronger Sense of Community

When you own, you’re not just passing through, you’re putting down roots. That often leads to stronger ties with your community, more connection to your neighborhood, and a deeper feeling of belonging where you live. That’s very different from the temporary nature of renting.

A Feeling of Accomplishment

There’s something powerful about getting the keys and walking into your own front door for the first time. It’s more than pride, it’s personal satisfaction. A quiet and meaningful sense of “I did this.”

Sure, it’s not always easy for first-time homebuyers right now. The market today requires patience, strategy, and sometimes a little creative problem-solving. But it’s still worth it. As Realtor.com says:

“Buying a home is a major commitment, but it’s also incredibly rewarding.”

When you get those keys in your hand, when you realize this place is where your life gets to unfold, it clicks. The stress, the waiting, the planning – all of it led you home.

Bottom Line

There are a lot of things out of your control right now. But building a life in a space that’s truly yours? That’s still possible with the right strategy and expert help. Talk to a local agent about how to make it happen.

What would it mean for you to finally have a place to call your own?

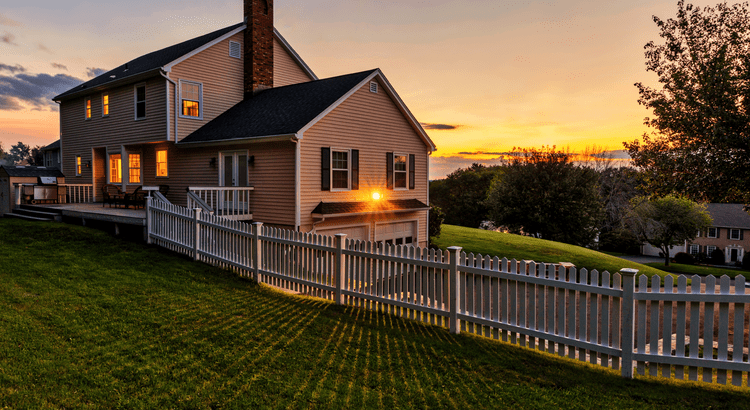

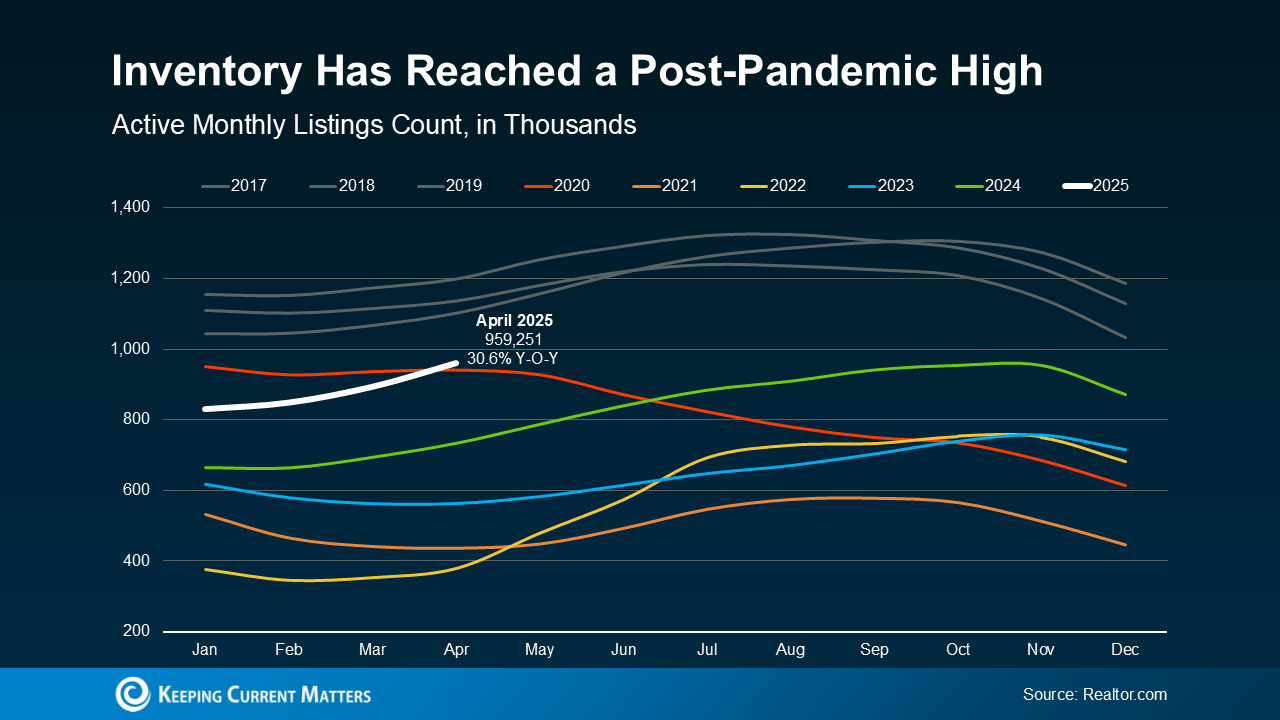

More Homes for Sale Isn’t a Warning Sign – It’s Your Buying Opportunity

Maybe you’ve heard the number of homes for sale has reached a recent high. And it might make you question if this is the start of another housing market crash.

But the reality is, the data proves that’s just not the case. In most areas, more inventory isn’t bad news. It’s actually a sign of the market returning to a more stable, healthy place.

What’s Going on With Inventory?

Based on the latest data from Realtor.com, inventory just hit its highest point since 2020, shown with the white line in the graph below.

But what you need to realize is, at the same time, inventory levels still haven’t returned to pre-pandemic norms (shown in gray):

That means there are more homes for sale now than there have been in quite some time.

That means there are more homes for sale now than there have been in quite some time.

And while it’s true inventory is up significantly compared to where it was over the last few years, the number of homes on the market is still well below typical levels. And that’s important context.

Why This Isn’t the Problem A Lot of People Think It Is

Some people hear inventory’s rising and immediately think about 2008. Because back then, inventory spiked just before the market crashed. But today’s situation is very different.

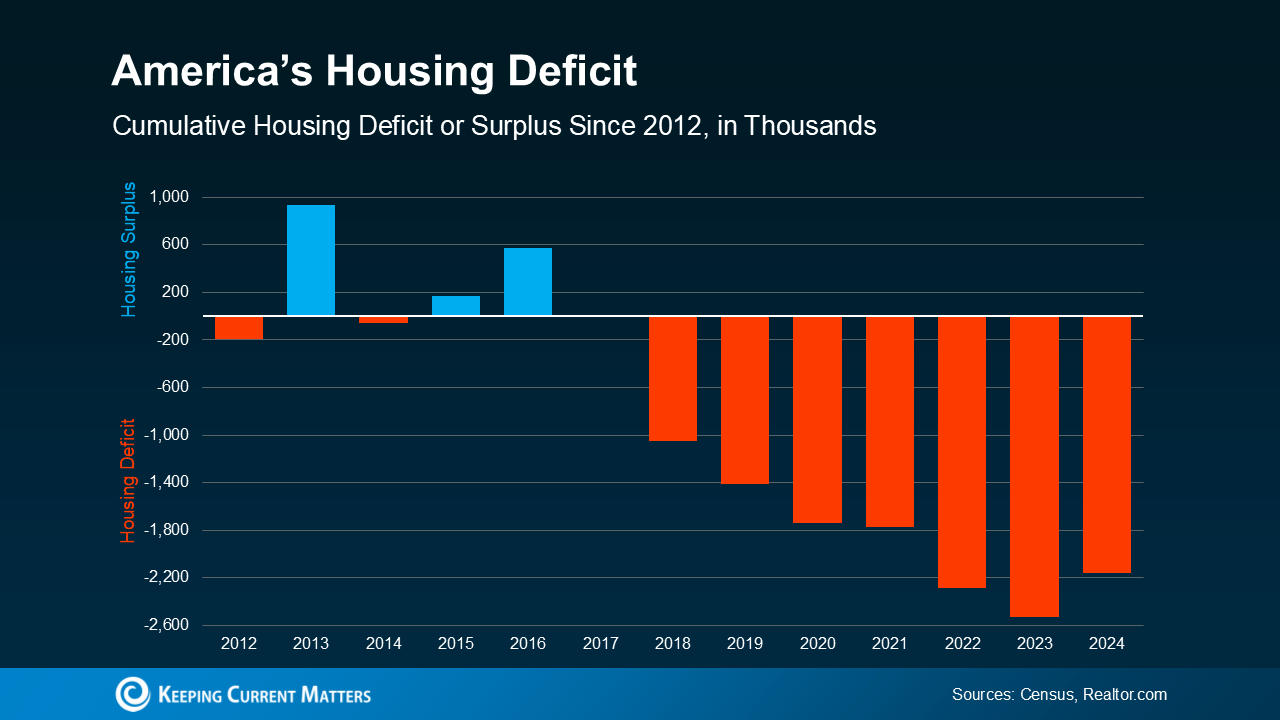

Here’s the key reason why. We don’t have a surplus of homes; we have a deficit to climb out of. What we’re dealing with is a long-term housing shortage – and it’s a big one.

The red bars in the graph below show all the years where housing starts (new builds) didn’t keep up with household formation, going all the way back to 2012. The deeper the bars in the graph, the more the housing deficit grew (see graph below):

And one of the reasons this housing shortage kept growing is because new home construction just didn’t keep up with the number of people who need to buy homes. In fact, the U.S. is actually short millions of homes at this point, and it will take years to overcome that gap. Realtor.com says:

And one of the reasons this housing shortage kept growing is because new home construction just didn’t keep up with the number of people who need to buy homes. In fact, the U.S. is actually short millions of homes at this point, and it will take years to overcome that gap. Realtor.com says:

“At a 2024 rate of construction relative to household formations and pent-up demand, it would take 7.5 years to close the housing gap.”

That means, in most areas, there isn’t a risk of having too many houses on the market right now. It’s quite the opposite – a vast majority of markets actually need more homes.

Which is why, even though inventory is rising, it’s not a problem on a national scale. It’s just helping to fill a gap that’s been growing for years.

Bottom Line

Don’t let the headlines scare you. Rising inventory isn’t a sign of a crash. It’s a step toward a more normal, stable housing market.

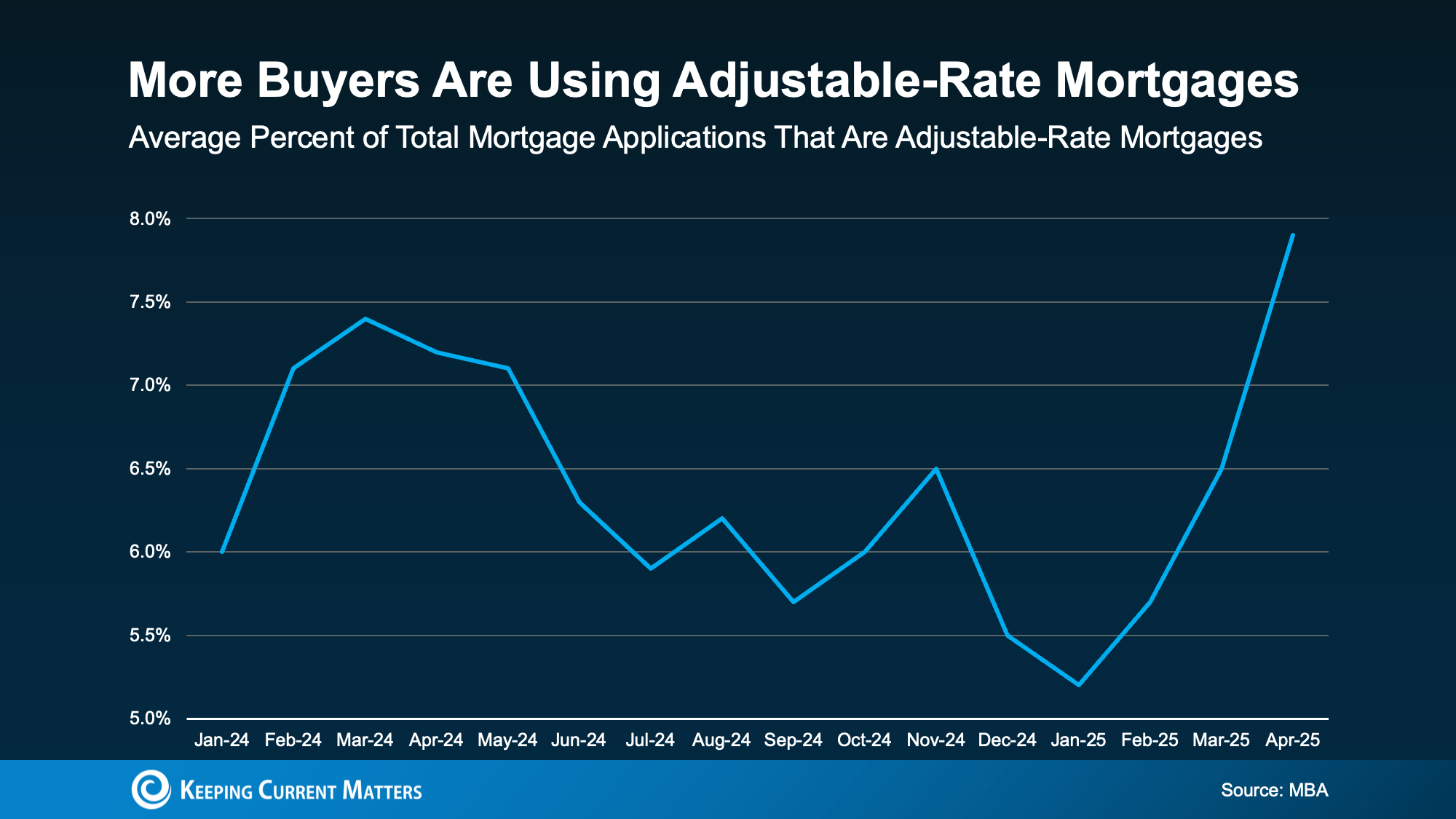

Thinking about an Adjustable-Rate Mortgage? Read This First.

If you’ve been house hunting lately, you’ve probably felt the sting of today’s mortgage rates. And it’s because of those rates and rising home prices that many homebuyers are starting to explore other types of loans to make the numbers work. And one option that’s gaining popularity? Adjustable-rate mortgages (ARMs).

If you remember the crash in 2008, this may bring up some concerns. But don’t worry. Today’s ARMs aren’t the same. Here’s why.

Back then, some buyers were given loans they couldn’t afford after the rates adjusted. But now, lenders are more cautious, and they evaluate whether you could still afford the loan if your rate increases. So, don’t assume the return of ARMs means another crash. Right now, it just shows some buyers are looking for creative solutions when affordability is tough.

You can see the recent trend in this data from the Mortgage Bankers Association (MBA). More people are opting for ARMs right now (see graph below):

And while ARMs aren’t right for everyone, in certain situations they do have their benefits.

And while ARMs aren’t right for everyone, in certain situations they do have their benefits.

How an Adjustable-Rate Mortgage Works

Here’s how Business Insider explains the main difference between a fixed-rate mortgage and an adjustable-rate mortgage:

“With a fixed-rate mortgage, your interest rate remains the same for the entire time you have the loan. This keeps your monthly payment the same for years . . . adjustable-rate mortgages work differently. You’ll start off with the same rate for a few years, but after that, your rate can change periodically. This means that if average rates have gone up, your mortgage payment will increase. If they’ve gone down, your payment will decrease.”

Of course, things like taxes or homeowner’s insurance can still have an impact on a fixed-rate loan, but the baseline of your mortgage payment doesn’t change much. Adjustable-rate mortgages don’t work the same way.

Pros and Cons of an ARM

Here’s a little more information on why some buyers are giving ARMs another look. They offer some pretty appealing upsides, like a lower initial rate. As Business Insider explains:

“Because ARM rates are typically lower than fixed mortgage rates, they can help buyers find affordability when rates are high. With a lower ARM rate, you can get a smaller monthly payment or afford more house than you could with a fixed-rate loan.”

On the flip side, just remember, if you have an ARM, your rate will change over time. As Barron’s explains there’s the potential for higher costs later:

“Adjustable-rate loans offer a lower initial rate, but recalculate after a period. That is a plus for borrowers if rates come down in the future, or if a borrower sells before the fixed period ends, but can lead to higher costs if they hold on to their home and rates go up.”

So, while the upfront savings can be helpful now, you’ll want to think through what could happen if you’re still in that home when your initial rate ends. Because while projections show rates are expected to ease a bit over the next year or two, no forecast is guaranteed.

That’s why it’s essential to talk with your lender and financial advisor about all your options and whether an ARM aligns with your financial goals and your comfort with risk.

Bottom Line

For the right buyer, ARMs can offer some big advantages. But they’re not one-size-fits-all. The key is understanding how they work, weighing the pros and cons, and thinking through if they’d be something that would work for you financially. And that’s why you need to talk to a trusted lender and financial advisor before you make any decisions.

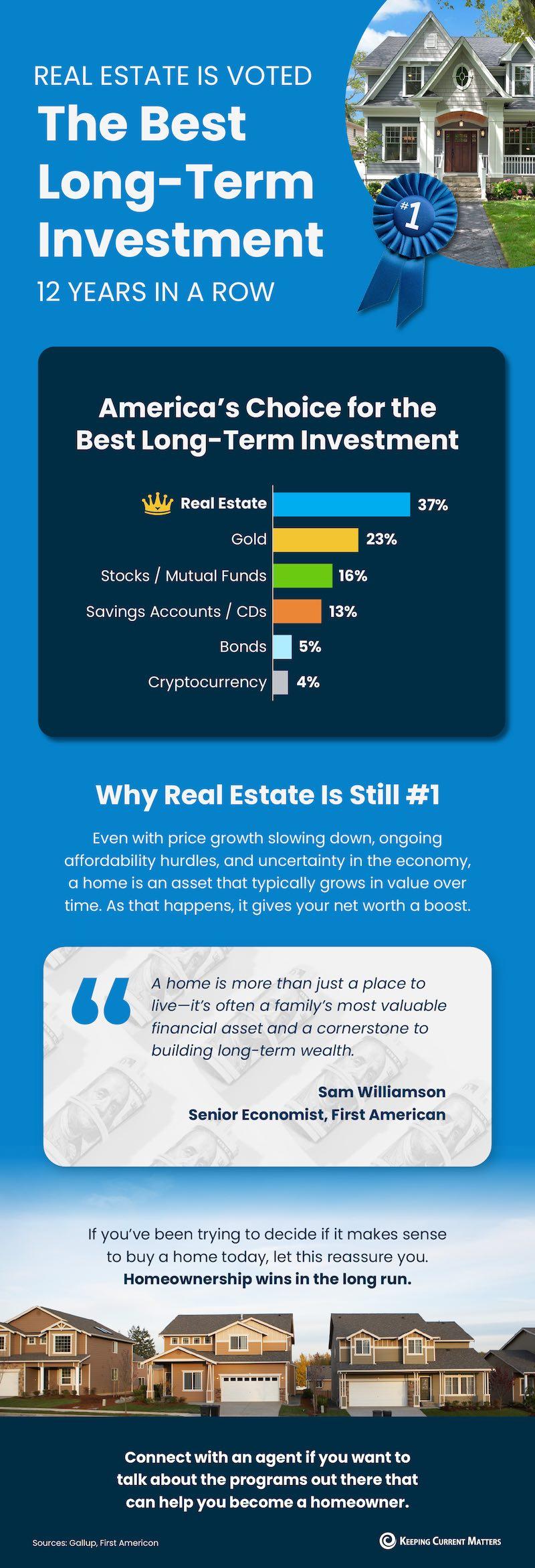

Real Estate Is Voted the Best Long-Term Investment 12 Years in a Row

Some Highlights

- In a recent poll from Gallup, real estate has once again been voted the best long-term investment. And it’s claimed that top spot for 12 straight years now.

- That’s because homeownership is one of the top ways to build your wealth, even with home price growth moderating and ongoing economic uncertainty.

- If you’ve been trying to decide if it makes sense to buy a home today, connect with an agent to talk about the programs that can help you become a homeowner.

Let’s connect to find out how I can help you find your perfect home with the best deal possible.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link